Tata Motors’ arm, Tata Technologies filed papers with the market regulator SEBI on March 10th to start an initial public offering (IPO) and raise funds. This resulted in a surge in Tata Motors shares. Under this public issue, Tata Motors plans to sell 8,11,33,706 Tata Technologies shares that the auto major acquired at ₹7.40 apiece. So, from the Tata Technologies IPO, Tata Motors is expected to get big gains. The market has gone bullish on Tata Motors share price.

About Tata Technologies IPO

Tata Technologies Limited (TTL) was founded in 1989. It is a global product engineering and digital services company. It focuses on fulfilling its mission of helping the world drive, build, fly, and farm by enabling global OEMs. And their ecosystem of partners across the automotive, aerospace, industrial machinery, and adjacent verticals to engineer, manufacture, and release better products, as well as helping them drive efficiencies in their businesses.

ADVERTISEMENT

The company has major offices in 17 countries and over 7,900 employees with over 5,000 clients. As per the Tata Technologies website, it was originally founded as a business unit of Tata Motors. In 1994 it started off as an independent business unit, headquartered in Singapore. The company began initiating operations in India in 1996.

Tata Technologies IPO

The IPO consists of a pure offer for sale (OFS) of up to 95.71 million shares. Tata Motors is offering up to 81.13 million shares, or a 20% stake in the company. Tata Capital Growth Fund I offering up to 4.86 million shares (1.20%), and Alpha TC Holdings Pte offering up to 9.72 million shares (2.40%).

Currently, Tata Motors holds a 74.69 percent stake in the company, while Alpha TC Holdings Pte and Tata Capital Growth Fund I hold 7.26 percent and 3.63 percent stakes, respectively.

The company’s shares are proposed to be listed on both the NSE and the BSE, according to a TOI report.

ADVERTISEMENT

IPO impact on Tata Motors shares

Talking about the impact of Tata Technologies on Tata Motors share price, Head of Research at Profitmart Securities, Avinash Gorakshkar, said,

“Tata Technologies is an IT company and Tata Motors has stake in this IT company that has applied to SEBI for its IPO. The IPO is expected to receive good response from investors due to the big name Tata being attached with the public issue. For Tata Motors, Tata Technologies IPO is going to bring cash flow as they acquired Tata Technologies shares at ₹7.40 per share (as written in the Draft Red Herring paper or DRHP).”

Gorakshkar revealed that the company has not yet fixed the IPO price. The Tata Technologies IPO price would be at least 4-5 times the rate at which Tata Motors acquired a stake in Tata Technologies.

Hence, Avinash Gorakshkar said that Tata Motors is expected to reap a huge benefit from Tata Technologies IPO.

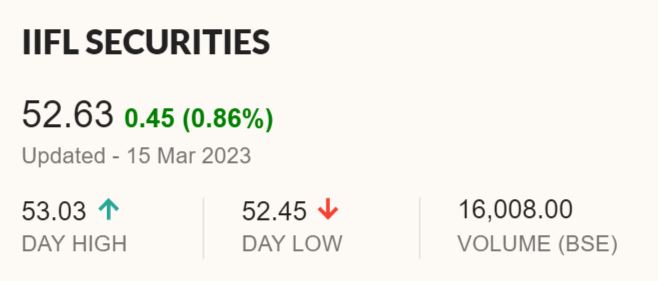

The Vice President of Research at IIFL Securities, Anuj Gupta spoke about how Tata Technologies IPO would benefit Tata Motors share price in the near term. He said,

“With Tata Technologies IPO, Tata Motors is going to book profit and hence cash flow in Tata Motors will go up after Tata Technologies share listing. In Q3FY23 results, Tata Motors beat the market estimates by big margin that has put Tata Motors shares in uptrend. This uptrend is expected to go further northwards after re-opening in China as it has big exposure in JLR sales in Chinese market. Hence, Tata Motors is expected to improve its balance sheet in upcoming quarter due to strong business outlook and Tata Technologies IPO is going to work as icing on the cake in near term.”

ADVERTISEMENT

Tata Technologies IPO GMP (grey market premium)

Tata Technologies IPO grey market premium (GMP) has risen from around ₹240 to ₹375 in two days. This shows a strong response from investors when the public issue opens on 22nd November 2023. Market observers stated that the rise in Tata Technologies IPO GMP despite weak sentiments on Dalal Street is praiseworthy.

The initial public offering (IPO) launch date

The initial public offering (IPO) of Tata Technologies Ltd is going to hit the Indian primary market on Wednesday next week i.e. on 22nd November 2023 breaking their streak of 20 years without any initial public offerings (IPO). The Tata Group company has fixed the Tata Technologies IPO price band at ₹475 to ₹500 per equity share. The public will only be able to subscribe to the IPO for two days, with the issue closing on November 24.

The grey market has gone highly bullish on the public issue worth ₹3,042.51 crore ahead of Tata Technologies IPO’s date of subscription opening. According to market viewers, shares of Tata Technologies Ltd are available at a premium of ₹375 in the grey market today.

What is the price band and lot size for the Tata Technologies IPO fixed by the company?

Tata Technologies IPO lot size comprises 30 Tata Technologies shares. The company will be selling its shares in the range of Rs 475-500 apiece with a lot size of 30 equity shares. Each lot of the company will cost Rs 15,000 to the investor.

ADVERTISEMENT

How will the Tata Technologies IPO benefit Tata Motors?

As per reports, Tata Motors will be able to improve its finances and reduce its debt by selling its equity stake in Tata Technologies. Tata Motors has cumulatively invested Rs 224.1 crore in Tata Technologies.

Speaking about debts, the company has reported a net loss in the last four consecutive years since 2018–19. Tata Motors suffered losses over the years due to its Jaguar Land Rover (JLR) unit and the poor financial performance of its domestic business.

Importance of the Tata Technologies IPO

After Tata Consultancy Services (TCS) which started in 2004. Tata Technologies is likely to be the first Tata Group company to go public in India after 19 years. Tata Technologies is also the 15th-largest IT company in the Fortune India Infotech Industry ranking.

Tata Play (formerly Tata Sky) is also expected to go for IPO this year.

ADVERTISEMENT

The company recently announced several corporate actions. Each share of Tata Technologies, with a face value of Rs 10, was divided into five shares of Rs 2. They were recently divided in a 1:5 ratio. The company thereafter announced a bonus issue in a 1:1 ratio. Hence, talking about Tata Technologies share price, each share of the company was turned into 10 shares effectively.

As per the TOI report, Link Intime India has been appointed as the registrar for the issue. JM Financial, Citigroup Global Markets India, and BofA Securities India are the book-running lead managers to the issue.

Tata Technologies IPO price

On the expected Tata Technologies IPO price, Head of Capital Market Strategy at Sharekhan by BNP Paribas, Gaurav Dua, said,

“Listing of Tata Technologies, subsidiary of Tata Motors, could unlock value for shareholders. Though the pricing is still not clear yet but the street expects the company to list at M-Cap of around Rs18000 crore. Consequently, it could roughly add ₹35 to ₹40 per share in SoTP valuation of Tata Motors.”

Tata Technologies IPO details

The issue is an offer for sale (OFS), under which shareholders will offload up to 9.57 crore equity shares, representing 23.60% of its paid-up share capital. The size of the IPO was not disclosed. Tata Technologies’ recent buyback valued the company at Rs 16,080 crore. Experts calculated that the size of the offer could be Rs 3,800 crore.

ADVERTISEMENT

The objectives of the OFS include that the company will not receive any proceeds from the OFS from the selling shareholders. Each of them will be entitled to the respective proportion of the proceeds of the IPO after deducting their portion of the offer-related expenses and the relevant taxes thereon.

Offer structure

Retail investors will get 35 percent of the net offer reserved for them. A retail investor can apply for a minimum of one lot or 30 equity shares, totaling Rs 15,000. A retailer can bid for 13 lots or 390 equity shares, amounting to Rs 1,95,000 at maximum.

Qualified institutional bidders (QIBs) and non-institutional investors (NIIs) will have 50 percent and 15 percent allocation in the net offer, respectively. NIIs investors need to bid for a minimum of 14 lots or 420 shares worth Rs 2,10,000. Big NIIs need to apply for a minimum of 67 lots or 2,010 shares, amounting to Rs 10 lakh.

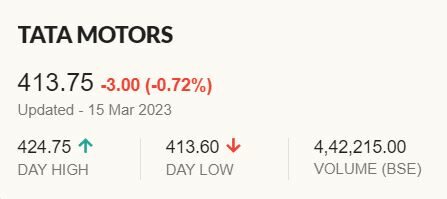

Tata Motors share price outlook

Expecting a strong rally in Tata Motors shares, Anuj Gupta of IIFL Securities said,

ADVERTISEMENT

“Tata Motors share price has strong support at ₹420 apiece levels and those who have this stock in their portfolio can hold the stock with stop loss below ₹420 per share levels. Those who want to buy Tata Motors shares can buy this auto stock at current levels for short to medium term target of ₹490 to ₹500 per share maintaining strict stop loss below ₹420 levels.”

Tata Technologies has reserved 20,28,342 shares for eligible employees of the company, while 60,85,027 shares, or 10 percent of the offer have been reserved for the shareholders of Tata Motors.

Tata Technologies’ financial condition

According to the DRHP, in the nine months (of the current financial year) ended Dec. 31, 2022. Tata Technologies’ revenue marked a 15.30% year-on-year growth to Rs 3,052.95 crore. The contribution of the services segment is 88% of the total revenue. The net profit increased 22.82% year-on-year to Rs 407.46 crore.

Disclaimer: The recommendations, suggestions, views, and opinions given by the experts (individual analysts or broking companies) are their own. These do not represent the views of Postoast. We advise investors to check with certified experts before taking any investment decisions.

Also read: 25 Lesser-Known Facts About Ratan Tata That Will Make You Respect Him More

ADVERTISEMENT

ADVERTISEMENT