Demonetization is a term that has gained significant prominence in India since 2016. It all started when the Indian Government declared the demonetization of ₹500 and ₹1,000 currency notes on November 8, 2016. The goal was to increase digital transactions, encourage a cashless society, and reduce corruption, fake money, and black money.

However, with this, the government has also introduced the ₹2,000 currency notes. It was intended to quickly address the monetary demands of the economy. In the fiscal year 2018–19, the production of notes of 2,000 yen was stopped.

ADVERTISEMENT

While demonetization sought to solve a number of socioeconomic problems, it was criticized on a number of fronts. Several analysts contend that the transition was detrimental to society’s underprivileged groups, who mostly relied on cash.

Being a bold and unprecedented move, demonetization has become an event that will always be etched in the memories of whoever experienced it. However, since then, it is always speculated that government might do another demonetization at any time.

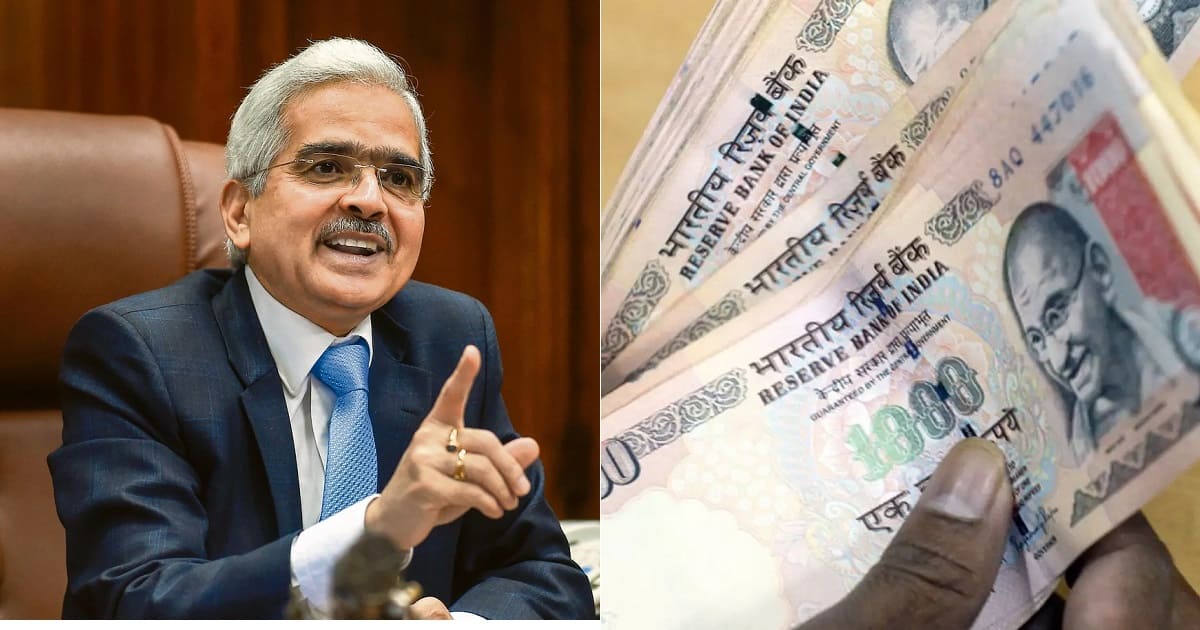

RBI stops the circulation of ₹2,000 currency notes

Now, the Reserve Bank of India (RBI) has announced its plan to remove the ₹2,000 currency notes from circulation. Soon, people started speculating that it might be another demonization. However, it is important to note that this time, notes didn’t lose their legal tender.

The RBI decided to discontinue the ₹2,000 currency notes for a number of reasons. One important factor is that the general people do not frequently deal with these currencies. Throughout time, the value of 2,000 currency notes has dropped. As of March 31, 2023, just 10.8% of the total quantity was made up of them.

ADVERTISEMENT

Furthermore, it is believed that the supply of other currency values is sufficient to suit the general population’s needs. This decision is in line with the “Clean Note Policy” of the RBI, which aims to ensure that the general public may obtain notes of high quality.

The RBI governor emphasized that the removal of ₹2,000 currency notes will have no effect on economic activity

Regarding the impact of the withdrawal, Shaktikanta Das stated that it would have no effect on economic activity. He referenced his own observations and unofficial polls to support the restricted use of ₹2,000 notes in transactions. 89% of the ₹2,000 banknotes that were printed before March 2017 and were expected to last four to five years have reportedly reached the end of their useful lives, according to news agency PTI.

According to the report, the total value of these banknotes in circulation has significantly decreased from its peak of ₹6.73 lakh crore on March 31, 2018 (which accounted for 37.3% of all notes in circulation) to ₹3.62 lakh crore, constituting just 10.8% of all notes in circulation as of March 31, 2023.

Beginning on Tuesday, anyone will be allowed to deposit or exchange ₹2,000 notes until the RBI’s deadline of September 30. Ten notes can be exchanged at most once, and deposits of ₹2,000 or more will also be subject to the current requirement of presenting a PAN card. It is noteworthy that the State Bank of India has said that exchanging ₹2,000 notes would no longer require ID proof or requisition papers.

In preparation for the summer, the RBI has given banks instructions to ensure that branches have the necessary infrastructure, such as shaded waiting spaces and water fountains. Banks must also keep daily records of the deposits and exchanges of ₹2,000 notes. The governor did, however, suggest that the September deadline may be altered depending on the current situation.

RBI to reintroduce ₹1,000 currency notes?

RBI governor Shaktikanta Das has made it clear that there are no intentions to bring back ₹1,000. Das said that the RBI’s decision to remove ₹1,000 currency notes from circulation will have little effect on the economy. It is because it barely accounts for 10.8% of the currency in circulation during a press conference.

ADVERTISEMENT

When questioned about the prospective return of ₹1,000, Das rejected the question as hypothetical. He said that there are no plans at the moment to implement such a policy. He emphasized that there are sufficient quantities of the current rupees (500 and 100) available to the general public, allaying concerns about the central bank’s ability to continue operating without the most valued rupee in India.

Das emphasized the system’s existing substantial supply of printed notes. He also pointed out that they are also accessible at the currency chests maintained by banks in addition to the RBI. He reaffirmed that despite the decision to remove ₹2,000 notes from circulation, they would continue to be considered legal money. He also asked people not to visit bank branches in a hurry, expressing confidence that this was not necessary.

Also read: 5 Unique Ways How People Are Getting Rid Of ₹2000 Note

ADVERTISEMENT

ADVERTISEMENT