Traveling can be a thrilling experience that enables people to discover new places and cultures and make priceless memories. Despite the excitement, it is essential to be aware of any hazards or unknowns that may exist while traveling.

In the wake of recent tragic incidents, such as the Odisha triple train tragedy, it has become imperative to prioritize the safety and well-being of passengers traveling on Indian Railways. To mitigate these risks, travel insurance has emerged as an essential safeguard, offering passengers complete assurance and security.

ADVERTISEMENT

To allay these fears, the Indian Railway Catering and Tourism Corporation (IRCTC) has unveiled a wonderful program. It is about travel insurance that enables travelers to obtain insurance coverage of Rs. 10 lakhs for just 35 paise.

IRCTC offers cheap insurance policy for passengers

Recently, the Indian Railway Catering and Tourism Corporation spoke with Manas Kapoor on the benefits of travel insurance (IRCTC). The interview provided information on the insurance coverage provided to customers who purchase tickets through the official IRCTC website.

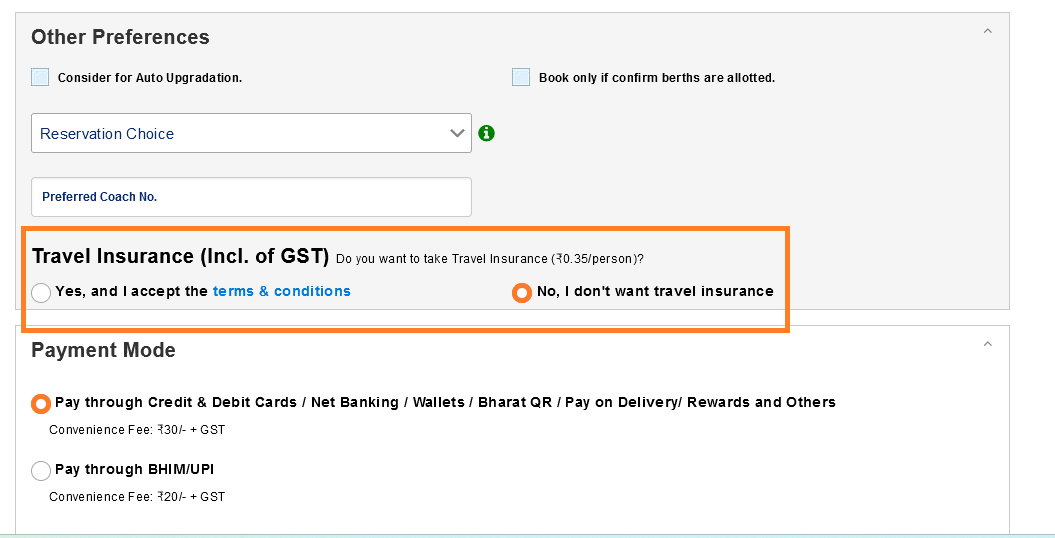

Notably, every Indian citizen can opt for travel insurance coverage while making a reservation on the official IRCTC website. Passengers may use this option by only paying a small fee of 35 paise per person. The insurance provider will instantly deliver the policy specifics through SMS and email to the passenger’s stated email address.

The passengers will also be given a URL to use to submit the specifics of their nomination. Importantly, this insurance policy is available for purchase for both adults and children aged 5 years and older.

ADVERTISEMENT

Details of IRCTC insurance policy

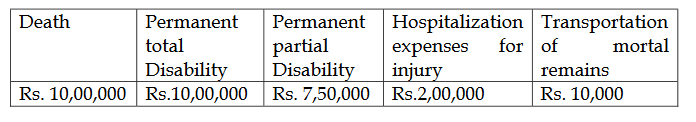

Travel insurance offers consistent coverage across all categories, ensuring equal benefits and premiums for all travelers. Those who purchase a travel insurance policy through the IRCTC site are protected against unlucky occurrences like death and disability. If a passenger suffered a fatality or a permanent and complete disability—especially in light of recent tragedies like the Odisha triple train accident—they or their designated dependents would receive Rs 10 lakh.

In the event of a permanent partial disability, the covered person is entitled to Rs. 7.50 lakh. Moreover, a passenger will get Rs. 2 lakh in compensation if they are hospitalized due to injuries sustained while traveling.

Furthermore, if a passenger passes away unexpectedly, the insurance provider will pay Rs 10,000. It will be given to transfer their lifeless remains to their home or a selected cremation or burial site.

Covers provided by the IRCTC under the travel policy

This insurance policy provides coverage in the unfortunate case of a passenger’s death or disability—whether entirely or partially—due to accident-related physical harm sustained while riding a train. Furthermore, it expands coverage to cover medical costs and the cost of transporting a passenger’s mortal remains in the tragic event of a passenger’s passing during a voyage as a result of an accident or unanticipated circumstances.

You can read complete terms and conditions of IRCTC optional travel insurance for e-tickets passengers here.

How to get a claim?

Within four months after the incident, the insured person, their nominee, or their legal heir must quickly inform the insurance company’s local office to begin the claim procedure. After the claim form, it is crucial to provide a thorough written statement as well as any relevant documentation or other proof pertaining to the occurrence, which must be given to the insurance provider.

ADVERTISEMENT

What differences are there when purchasing tickets through private web portals?

Although there is no intrinsic advantage to purchasing tickets through online portals, it is advised to think about buying them directly through the Next Generation E-Ticketing (NGeT) platform. By doing this, the chance that the insurance provider will absolve itself of responsibility for claim settlements made under the travel insurance policy is reduced.

In conclusion, the travel insurance coverage offered by the IRCTC while purchasing tickets on the official portal is an essential improvement to the services offered to passengers. Passengers may obtain complete coverage for only 35 paise. This initiative exemplifies IRCTC’s commitment to improving the traveling experience and safeguarding the security and happiness of its customers.

ADVERTISEMENT