We all pay taxes. Voluntarily or involuntarily, the taxation system is woven into the fabric of our lives. Everything has a price, from necessities to luxuries, and every price comes with tax. Not only this, we also pay taxes on our incomes. What if we tell you some countries do not have an income tax system? You might be wondering if they are not taxing their citizens, how are they generating revenue. These countries have other sources, such as mining, tourism, or crude oil.

These countries not only don’t have tax systems, but they are also beautiful enough to make you want to relocate if you’re tired of tax season.

ADVERTISEMENT

Let’s have a look at these countries:

1. UAE (United Arab Emirates)

The UAE is a stunning country situated at the eastern end of the Arabian Peninsula, with a thriving economy and a multicultural atmosphere. Whether it’s education or healthcare, the UAE offers excellent amenities to its residents. The cherry on top is that the UAE is a tax-free nation.

In this country, citizens enjoy a high quality of life without having to pay any taxes on their income. The primary source of revenue for the government comes from corporate taxes levied on oil companies and foreign banks. Additionally, there are no requirements for tax registration or reporting, making it a hassle-free experience for individuals.

2. Monaco

Monaco, the second smallest country in the world, is located on the Mediterranean Sea. Despite being one of the most expensive places to live, it boasts the lowest crime rate in the world, making it a safe and beautiful country to live in.

ADVERTISEMENT

Monaco has long been considered a tax haven due to its favourable personal and corporate tax regimes. The country doesn’t tax individuals on their income, and corporations within the country receive preferential tax treatment.

3. Cayman Islands

The Cayman Islands, located in the Caribbean Sea, are also well-known for being a tax haven. Apart from being free of income tax, the country also does not impose payroll, capital gains, and withholding tax. Moreover, it has no corporate tax, which makes it a popular choice for multinational companies to establish subsidiaries and protect themselves from taxation. Thus, it’s safe to say that the Cayman Islands are one of the best countries for tax-free business.

However, living in this country can be very expensive, and obtaining long-term residency requires a significant amount of money. Nonetheless, if you’re willing to make substantial investments in local businesses or real estate, the Cayman Islands may be the ideal place for you.

4. Qatar

Qatar is a wealthy country situated in the Persian Gulf and is known for its abundant oil reserves. One of the unique features of Qatar’s taxation system is that it does not impose income tax on an individual’s allowances, salaries, and wages. Instead, it follows a territorial taxation system, where individuals are only liable for taxation if their income is derived from sources within Qatar.

5. Bahrain

Bahrain is a small archipelago made up of 50 natural and 22 manmade islands. There is no personal tax, estate tax, sales tax, or capital gains tax in this oil-rich country. On the other hand businesses in the oil and gas industry, face significant taxation.

6. The Bahamas

The Bahamas is a beautiful country located in the West Indies which offers attractive tax-free benefits. Unlike in other countries, obtaining citizenship is not mandatory to enjoy tax-free living. The permanent residency requirement is only 90 days.

ADVERTISEMENT

To qualify for “rapid consideration,” expatriates must have owned a home for at least ten years and have a minimum purchase amount of BSD 750,000. The Bahamas government imposes no taxes on its inhabitants, including income, capital gains, inheritance, or gifts. Instead, the country earns money from VAT and stamp taxes.

Additionally, The Bahamas has severe regulations prohibiting unlawful financial activity such as money laundering.

7. Bermuda

Bermuda is a gorgeous island in the North Atlantic known for its stunning beaches. Bermuda imposes no taxes on profits, income, dividends, or capital gains, and there are no limits on the accumulation of profit or requirements to distribute dividends. However, employers are required to pay a payroll tax.

8. Kuwait

Kuwait is situated at the end of the Persian Gulf and shares borders with Iraq to the north and Saudi Arabia to the south. One of the advantages of living in Kuwait is that there is no income tax imposed on individuals. However, foreign companies are subject to corporate taxes. Additionally, both the employer and employee contribute towards Social Security.

ADVERTISEMENT

9. Dominica

Dominica is one of the countries that doesn’t impose taxes on income. It does not have corporate, estate, or withholding taxes. Additionally, there are no taxes on gifts, inheritance, and income earned from foreign sources.

Dominica has laws that make it easy to establish offshore foundations, trusts, and corporations. It also offers offshore banking services that are both tax-friendly and private.

It’s worth noting that people from any country can form offshore corporations in Dominica, and the country has laws in place to protect the identity of the owners and directors of these companies. Additionally, Dominica does not share any information about its offshore account holders with any other nation’s tax authorities.

10. Oman

Oman is yet another Middle Eastern country on the list. Oman heavily relies on oil and gas for revenue and has no personal income tax. Additionally, there are no taxes on income from property, wealth, capital gains, or inheritance.

ADVERTISEMENT

However, the government of Oman is assessing the implementation of a Personal Income Tax Regime as a part of its 2020-2024 Medium-Term Fiscal Plan.

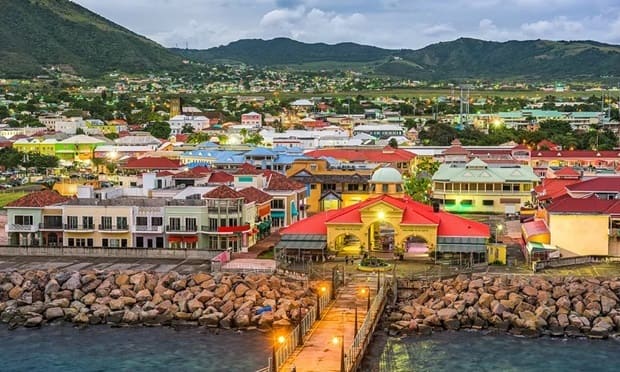

11. St. Kitts and Nevis

Saint Kitts and Nevis is a Caribbean Island nation consisting of two islands, which are renowned as a romantic paradise. Since gaining independence in 1983, St Kitts and Nevis has never imposed personal income taxes on its citizens or residents. Tourism is the government’s main source of revenue, and they also provide economic citizenship programs to foreigners.

12. Vanuatu

Vanuatu is one of the most breathtaking tropical island destinations in the South Pacific. There are no income taxes, taxes on profits, dividends, or capital gains tax in the country. Applicants for Vanuatu’s citizenship with a clean criminal record, a legitimate source of funds, and good health can obtain a new passport in 30 days.

All these countries are beautiful tax-free paradises. You too can avoid the tax season by taking citizenship in the country of your choice.

ADVERTISEMENT

ADVERTISEMENT