For many people, owning a home is an important milestone that signifies financial stability and independence. It is a significant financial decision that can provide numerous benefits, both in the short and long term.

However, in recent years, there has been a trend among younger people to prefer renting homes rather than buying them. Nevertheless, this shift in housing preferences is not without its reasons. Several factors can influence a person’s decision to rent or buy a home, and younger people may have different priorities and preferences than previous generations.

ADVERTISEMENT

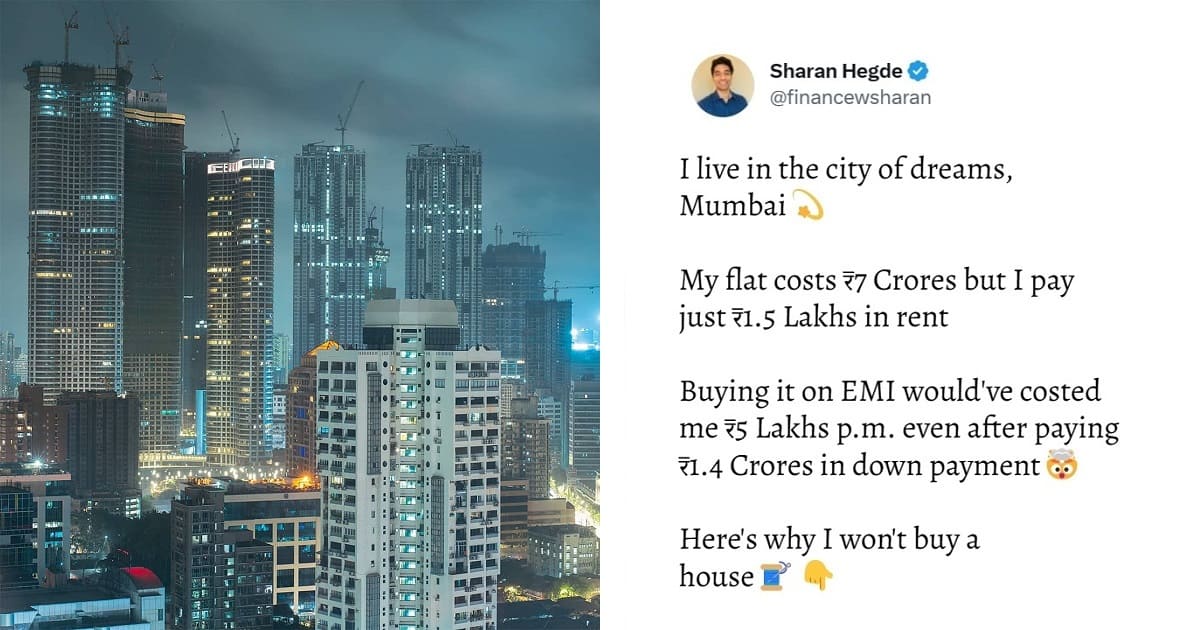

Recently, Sharan Hegde, a finance content creator, also explained the same phenomenon and listed the reasons why he prefers paying high rent to buying a house.

Sharan Hegde listed out the reasons behind his choice to not buy a house

Recently, Sharan Hegde, a finance creator, took to Twitter to share his thoughts on the topic of buying a house versus renting one.

According to his tweet, he currently resides in Mumbai and pays a rent of Rs 1.5 lakhs per month for his flat. He then shared that the flat he lives in is valued at Rs 7 crores, and the monthly EMI for buying it would be Rs 5 lakhs, in addition to a down payment of Rs 1.4 crores. After crunching the numbers, he concluded that he prefers renting to buying.

In a series of tweets, Sharan Hegde provided five reasons to support his analysis of why renting a house is more favorable for him. While the reasons may differ from person to person based on individual circumstances and priorities, his insights provide valuable food for thought for those contemplating the decision of whether to buy or rent a home.

ADVERTISEMENT

I live in the city of dreams, Mumbai💫

My flat costs ₹7 Crores but I pay just ₹1.5 Lakhs in rent

Buying it on EMI would’ve costed me ₹5 Lakhs p.m. even after paying ₹1.4 Crores in down payment🤯

Here’s why I won’t buy a house🧵👇

— Sharan Hegde (@financewsharan) March 2, 2023

Reason 1

[1] Rent is not burnt

Rather than buying, if I invest:

🔶₹1.4 Cr of Down-Payment and

🔶₹3.5L (EMI less Rent) p.msay, in Nifty 50 Index Fund which gets me 12% p.a. for next 20 yrs?

I’ll have ₹48.13 Cr🤯

Even if flat grows at 7% p.a., it’ll be worth ₹27 Cr📉

— Sharan Hegde (@financewsharan) March 2, 2023

Reason 2

[2] Buy a Home after having FIRE score

How much money you need to never ever worry about money?

Me: ₹6 Crores!

At 10% growth I get 60L p.a

I need 30L a year to live the dream life and another 30L reinvested to match 5% inflation

After 20 yrs, I can have that house + ₹20Cr

— Sharan Hegde (@financewsharan) March 2, 2023

Reason 3

[3] Disproportionate Asset Allocation

If I buy a house worth ₹7 Crores today,

Most of my net worth will be allocated in a flat

A flat is generally a laggard in terms of capital appreciation

What for? Saving just ~2% per year?

— Sharan Hegde (@financewsharan) March 2, 2023

Reason 4

[4] Is it just about the EMIs?

Did you forget that buying a house comes with:

🔶Registry [4-7%]

🔶Brokerage [1-2%]

🔶Heavy & recurring repair & maintenance

🔶Annual Property Taxesand what not!

— Sharan Hegde (@financewsharan) March 2, 2023

Reason 5

[5] More clarity over which city to live

Right now, I am in Mumbai because of my work

What if I feel like shifting to Goa?🏖️ Or say, Manali?🏔️

Buying a house will lock me not just emotionally but financially as well

It might make more sense to buy a house in 40s

— Sharan Hegde (@financewsharan) March 2, 2023

Sharan Hegde’s opinion on renting versus buying a house sparked a heated discussion on Twitter, with many people expressing their views on the matter. While many people agree with him, some users criticize his perspective, claiming that only someone who can afford to pay a high rent of Rs 1.5 lakhs per month would suggest renting over buying.

ADVERTISEMENT

Others argued that buying a home is often an emotional decision rather than a purely financial one. For them, the sense of security and ownership that comes with having a roof over one’s head is worth more than any monetary value.

Good thread lots of informations are missing as after 20 years , rent will not be same as 1.5 lacs but it will increase every year from 10% according to mumbai rates. And in mumbai , brokers take brokerage every year equal to one month rent.

I believe owning one house is…

— Aakanksha Gupta (@aakankshalovely) March 5, 2023

Would love to know if your family owns one or more houses that you’re likely to inherit?

— 🌈Sherina (@Sherinapoyyail) March 2, 2023

1.5L rent? Useless advice from another offspring from an elite and rich family.

— Sayak Dipta Dey (@sayakdd28) March 2, 2023

ADVERTISEMENT

The people reading this post will definitely see after few years that this guy is buying his own house, waiting for the Irony🤣🤣

— Ashim Das (@AshimDa93235118) March 3, 2023

Don’t buy a home , don’t buy a car, don’t buy clothes..what next don’t buy food ?

Everything in life is not about an Excel sheet there are human emotions, sense of achievement and satisfaction.

No matter what type of a house you rent it can never beat the satisfaction of owning— Citizen Of ಕನ್ನಡಸ್ಥಾನ (@speakistan) March 2, 2023

1.5 Lakh???? Delhi aa jao bc pic.twitter.com/xNV4CPlQq5

— Dhruv (@CatfluentDhruv) March 3, 2023

Maan I hate influencers, even more than paneer biryani!!

— shubhankar.c (@monkeypreneur) March 3, 2023

ADVERTISEMENT

Great and very valid points Sharan. But owning one house for self use provides lot of peace of mind (esp given how tenants are treated in bbay bldgs, no rights/voice, most upmarket complexes don’t rent to single ppl, plus no pains of uprooting phy & mentally every 1/2yrs….)

— گریش Girish Mallya (@girishmallya) March 3, 2023

One house is mandatory, BUSINESS, LIFE, JOB, MONEY INFLOW is never same it’s always up and down specially when you are single earning member in family, guys please don’t follow this rubbish advice. One permanent roof is important. 🙏

— Swapnil Aggarwal (@SwapnilAggarwa3) March 3, 2023

Homy buying is an emotional decision than a financial one.

It is that sense of having a piece of own roof over head goes beyond any financial senses.

— Kumar Manish (@kumarmanish9) March 2, 2023

Personal finance is more personal than finance, decide what works best suiting your risk profile, goals and affordability and if you want stability buy a house (May not be 7cr) or if you are alone or your partner and you are happy not to attach to a particular place , renting is

— rishabh parakh (@CARishabhParakh) March 3, 2023

ADVERTISEMENT

Buying our home (paid off) saved us in lockdown and Covid times.. no income for years, and paying rent would have driven us to despair… your calculations make sense for you … everyone has different requirements and lives.. tc

— Sᴜᴢᴀɴɴᴇ Bᴇʀɴᴇʀᴛ (@suzannebernert) March 3, 2023

The discussion highlighted the various factors that influence the decision to rent or buy a home, including financial considerations, personal preferences, and emotional attachments.

What do you think about this? What side are you on?

Also read: 9 Most Most Expensive House In Mumbai And This Is How Much They Cost

ADVERTISEMENT

ADVERTISEMENT