The second season of Shark Tank India has been winning hearts very much like season 1. Fans were brimming with excitement for season 2 to air, though they were a bit disappointed initially as Ashneer Grover, the BharatPe founder, was not included in the panel of judges. Now, the thing everyone is talking about is the current financial status of its judges and their companies. Are the companies of the Shark Tank judges really running in losses?

Who initiated the conversation?

Everything started when Harsh Vardhan Goenka, who is the chairperson of the Indian RPG Group conglomerate which is worth $3.80 billion worth, took to Twitter to share his views on the current financial status of the “Sharks”.

ADVERTISEMENT

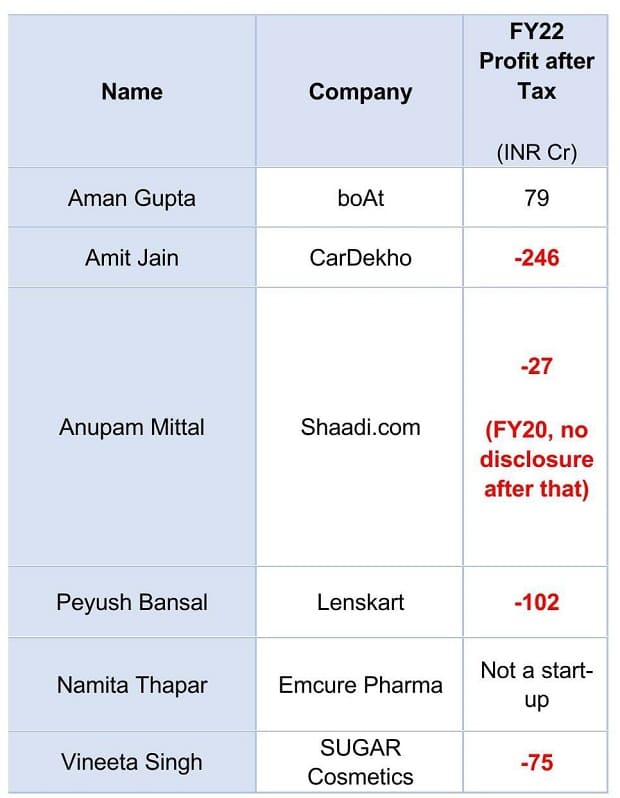

After posting a screenshot of the Financial Year 2022 earnings of the companies headed by the Shark Tank India judges, ending March 2022, Goenka added that it reminded him of the movie Jaws. He even went ahead and commented “bleeding” sharks mockingly.

What did Harsh Goenka’s numbers say?

According to Harsh Goenka’s tweet which went viral, all the sharks are drowning in losses except for Aman Gupta. It shows that only Aman Gupta’s, boAt, seems to be reporting a positive figure of Rs 79 crore while the rest are marked in negative and red.

The other companies which include Amit Jain’s CarDekho, Anupam Mittal’s Shaadi.com, Peyush Bansal’s Lenskart, and Vineeta Singh’s SUGAR Cosmetics, are all running in losses. Emcure Pharma’s numbers, headed by Namita Thapar, were not included as it is not a startup like the other companies.

But Goenka never mentioned where he sourced these stats from.

ADVERTISEMENT

I enjoy #SharkTankIndia as a program and I think it is a great platform for our budding entrepreneurs.

1

But whenever I think of sharks, I think of the movie ‘Jaws’ and bleeding 🩸! pic.twitter.com/LAmGxQOiU8— Harsh Goenka (@hvgoenka) January 22, 2023

Are Goenka’s numbers even correct? What is the source of these pieces of information?

The Shaadi.com founder, Anupam Mittal, who has appeared in both seasons of Shark Tank India as a “Shark” has jibed back to the tweet on January 24, 2023, adding that Goenka’s data appears to be “superficial, biased and incomplete”. However, Mittal didn’t share any new numbers to contradict Goenka’s numbers.

Mittal said,

I know you meant it in jest so with all due respect sir, I think u reacted to what appears to be superficial, biased & incomplete data. Happy to learn from stalwarts, but just to clarify, like u, the sharks 🦈 don’t bleed red, we bleed blue 🇮🇳 & that’s why we do what we do 🤗

I know you meant it in jest so with all due respect sir, I think u reacted to what appears to be superficial, biased & incomplete data. Happy to learn from stalwarts, but just to clarify, like u, the sharks 🦈 don’t bleed red, we bleed blue 🇮🇳 & that’s why we do what we do 🤗

— Anupam Mittal (@AnupamMittal) January 24, 2023

The exact statistics behind Shaadi.com’s 2022 financial year records are yet to be precisely determined as Shaadi.com has not revealed its financial year numbers ever since FY20, ending March 2020.

Reportedly, Mittal has asserted that the company is profitable indeed and will be IPO-ready in about 12 months. But it faces neck-to-neck competition from other matrimonial sites namely Bharat Matrimony and Jeevansaathi.com, both of which have already gone public.

ADVERTISEMENT

Sir, ‘actual’ data toh saamne hai. > 90% of the cos Sharks have invested in r unprofitable so the argument that ‘they are red but only look for green’ is fundamentally flawed. As for my cos, my stakeholders are regularly updated. And for those reasons, I am out. All the best 😉

— Anupam Mittal (@AnupamMittal) January 26, 2023

Peyush Bansal and Lenskart

The popular eyewear company Lenskart, founded by Peyush, has been having an impressive promotional run these days with its humourous commercials featuring Peyush Bansal as well as film director Karan Johar. Entrackr, a startup information portal, and tracker does state in a report dated November 10, 2022, that Lenskart has indeed run into losses in FY2022, ending March 2022. According to Entrackr’s report, the company has seen a spike of over 72% in the total cost, which has led to a loss of Rs 102 crore in FY22.

Vineeta Singh and SUGAR Cosmetics

Vineeta Singh, the founder and CEO of the popular makeup brand SUGAR, has been unfortunately facing a long streak of losses every fiscal year. In FY21, SUGAR has reportedly faced losses of over Rs 21.1 crore, which surprisingly jumped by 255% to a loss of Rs 75 crore in FY22.

ADVERTISEMENT

From turning down a Rs 1 Crore job offer to starting her own venture, Shark Vineeta Singh of SUGAR Cosmetics defines the true meaning behind “Will to chase your entrepreneurial dream!” pic.twitter.com/4LUU8n1MyA

— Shark Tank India (@sharktankindia) December 7, 2022

Amit Jain and CarDekho.com

Amit Jain, the founder of Cardekho.com, is one of the new judges in season 2. The FY22 numbers of the car search and purchase platform’s own website have been actually pretty impressive. According to a report by Business Insider, the company has seen 81 percent growth in its consolidated revenue from operations.

So is it true?

Although with different statistics, Goenka’s assertions hold true. While Aman Gupta is still making profits with his company boAt’s, the others have indeed faced losses.

ADVERTISEMENT