Finance is the backbone for every small, medium, or large business. Sometimes funds are required to meet working capital requirements and other times, these are needed to meet the expansion plan requirements. In both the cases, a business loan can help pay for both operations and expansion.

Maybe you need a new office, an asset, or some other business equipment, but the myths might stop you from applying for a small Business Loan.

ADVERTISEMENT

Let’s dive right in and start busting some small Business Loan myths.

Small Business Loans Myths Busted

Myth #1: A Perfect Credit Score is a Must

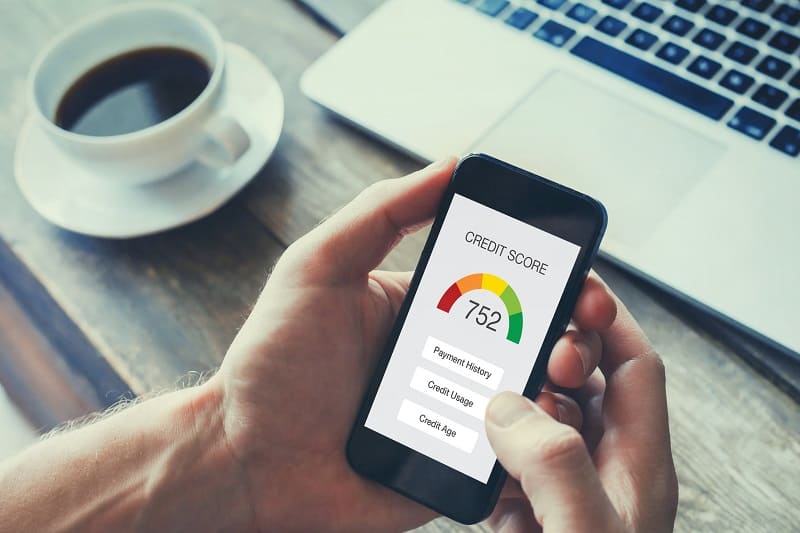

The number one myth says that you need the perfect credit score to get a Business Loan approval. But the questions are – what is the perfect credit score? Is it 900? Who calculates the credit score?

The credit score ranges between 300-900. The score is calculated by credit bureaus such as CIBIL and Experian. Each bank and NBFC may use any one or both of the bureaus for their verification and approval process.

Coming to the score, while 900 is not impossible, many banks and NBFCs consider a score of over 750 as excellent. An

ADVERTISEMENT

Experian score of 750 is a good score and you are not considered a risky borrower.

The credit score is not the only factor determining the borrower’s eligibility. Other aspects such as business past revenue reports, cash inflow, profits, and other financial statements also determine your business’s creditworthiness.

Do remember that a high credit score will weigh heavier than other determinants, so it is good to have a higher rating. The first step to improving your credit score is understanding your business credit status and whether it has any outstanding debts.

Myth #2: Business Loan Approval Takes Forever

We have all heard this one – applying for a Business Loan is an ordeal and it takes forever to get the approval. We are calling it a myth for a reason! It is all thanks to new-age loan providers like Clix Capital, who have streamlined the process for Business Loans – you can get a loan approved in a short time.

You also must follow the business loan approval process for quick approvals. It involves understanding the eligibility, ensuring the application process is filled correctly, and uploading all the required documents. Do not forget to check the eligibility using the Business Loan EMI calculator for small Business Loans.

Do not get carried away with statements like loan is approved faster if the business is more than a few years old, preferably three. It only means you are meeting the eligibility, making it easier for the NBFC to approve the loan in the minimum time possible.

ADVERTISEMENT

Myth #3: A New Business Will Not Get Funds

Many people confuse a new business with a start-up. These are two totally different types of businesses. A new business for many lenders means opening a new branch office, adding a new warehouse, etc. So, if you are starting a new business, do not fall for the myth that you will not get funds.

We are repeating ourselves – your business needs to meet the eligibility criteria of the loan provider and provide all the documents to get the funds. The myth is applicable to those who do not follow these simple rules.

What are the things that the loan provider will check – business vintage, business ownership, etc. These criteria vary across banks and NBFCs. Go to the website to understand what is required and make sure you can produce the numbers and documents to get the funds to start a new business in the same city as the old one or a new city.

Myth #4: You Need to Have a Collateral to Qualify

The biggest myth about taking out a loan for small businesses is that you need collateral to qualify for the loan. This isn’t true. You do not need to have a collateral – it is possible to get a loan without a collateral. Not every small business can have a collateral that they can pledge to get a loan approved.

ADVERTISEMENT

This mistake in understanding the nature of SME Loans is made because businesses are required to provide proof of profit and other bank statements to get a loan. It is common procedure adopted by banks and NBFCs, and somehow the myth about the necessity of a collateral got added.

There is one important thing to remember, a loan with a collateral is more likely to get you a lower interest rate as compared to a small Business Loan with no collateral.

Myth #5: The Application Process is Too Complicated

The application process involved in a small Business Loan can seem daunting if the business owner or borrower does not understand the eligibility criteria and terms and conditions. Reading them carefully and following the processes defined will give a clear idea of expectations.

New age NBFCs such as Clix Capital provide access to the complete loan details on their websites, apply for a business loan online making it easier.

ADVERTISEMENT

The process is straightforward, simple and can be completed online.

Wrapping Up

It is high time to put such myths to rest. Banks and new-age NBFCs empower business owners to achieve their objectives with easy to follow processes and applications. They only require a correctly filled application form and certain documents that will enable them to approve the small Business Loan.

ADVERTISEMENT