A society cannot function without taxes since they provide the funding for infrastructure and public services. Its importance comes from its capacity to pay for vital public services like healthcare, transportation, and public safety. These services are essential for social development and well-being. Nonetheless, a high tax burden may have unfavorable effects.

But when taxes become too burdensome, they may have a significant effect on people’s lives. It can stifle economic expansion by lowering disposable income, reducing personal savings, and reducing discretionary expenditure. High taxes may also impede employment creation and innovation, inhibit corporate expansion, and discourage entrepreneurship.

ADVERTISEMENT

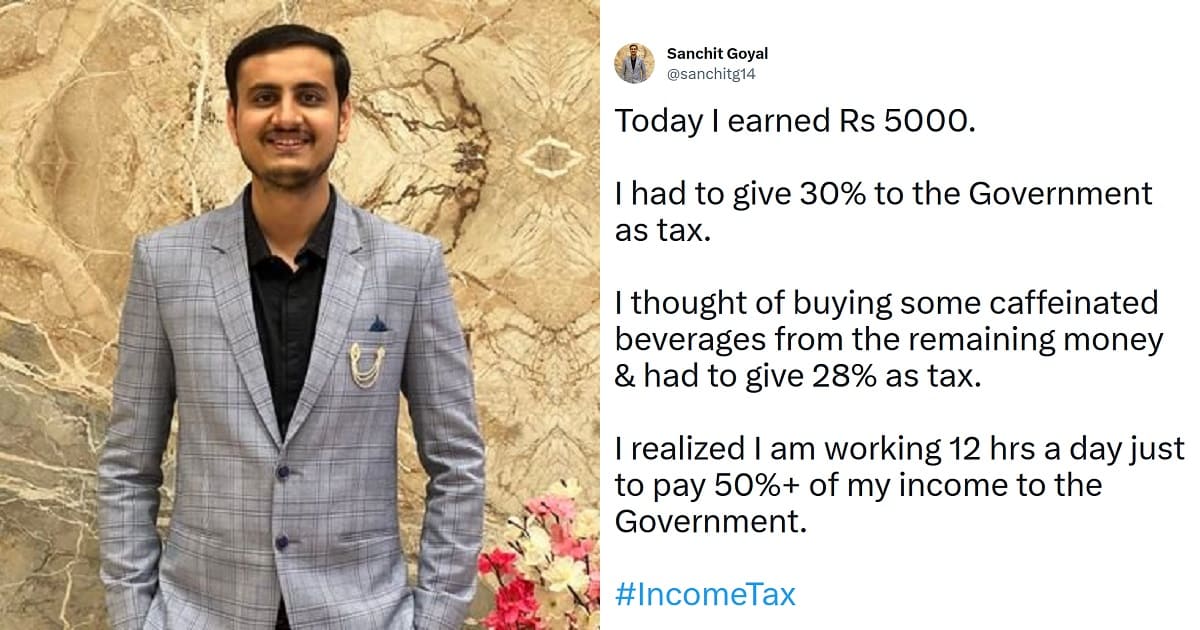

A Flipkart employee claimed that 50% of his income goes to tax.

From time to time, many people share their displeasure with the amount of tax they pay. Recently, it was exemplified by a recent tweet from Sanchit Goyal, an employee at Flipkart. Goyal voiced his displeasure by emphasizing the substantial portion of his income that he was required to pay in taxes. Taking to Twitter, he wrote,

“Today I earned Rs 5000. I had to give 30% to the Government as tax. I thought of buying some caffeinated beverages from the remaining money & had to give 28% as tax. I realized I am working 12 hrs a day just to pay 50%+ of my income to the Government. #IncomeTax”

Today I earned Rs 5000.

I had to give 30% to the Government as tax.

I thought of buying some caffeinated beverages from the remaining money & had to give 28% as tax.

I realized I am working 12 hrs a day just to pay 50%+ of my income to the Government. #IncomeTax

— Sanchit Goyal (@sanchitg14) July 15, 2023

Sanchit further wrote that the items he buys came with extra taxes, leaving him feeling overburdened

In another tweet he wrote,

ADVERTISEMENT

Tax earned by Government on Rs 20 choco-bar:

18% GST by end customer – Rs 3.6

Calculated on unit economics-

18% on Sugar – Rs 0.36

18% on Cocoa – Rs 0.9

12% on Condensed Milk – Rs 0.6

5% on Cream – 0.1Total #GST earned – Rs 5.5 which is close to 27.5% of the final cost.#tax

— Sanchit Goyal (@sanchitg14) July 18, 2023

Soon, his tweets went viral, and several Twitter users responded to his remark by echoing his comments and expressing their concerns regarding the distribution of tax funds. Other users voiced their displeasure at the alleged misuse of taxpayer money. They also alleged that a sizable amount is allocated to pay for wages, pensions, and pointless subsidies instead of infrastructure improvement.

Below are some of the reactions to his tweet

Earn money from agriculture and drink tender coconut water. 0 tax

— Hari Prasad (@tweetmehariP) July 16, 2023

FM is working for 18 hrs to determine how to tax 100% of your income so that you don’t get worried about investing, safety of money, getting married, having kids, buying a home etc and work for 24 hrs without pay, that is Ram-Rajya when they wud like you believe we will dole you

— Ramesh K Iyer (@rameshkiyer) July 16, 2023

and your blood boils when you know that a great portion of tax revenue is going towards salaries, pensions of Government employees and unnecessary freebies rather than building infrastructure.

— Satish Reddy (@satishv1024) July 16, 2023

This is the pain of middle class today. If you buy a car there’s not only 28% gst but also 22% cess . Plus 10% road tax. Approx 150% fuel tax and 2.5 euppe per km toll tax.

— AAP Ke Mirza G (@iMirzaG) July 16, 2023

ADVERTISEMENT

Ice cream is an luxury item with 18% gst. I didn’t know that u have to be rich to eat ice-cream.

— Chandra sekhar panda (@sekhar230590) July 18, 2023

This is what’s the situation of the middle class salaried people buddy. We work only to pay tax. Ultimately, if you see GST is something that the customer has to pay and not the businesses from their pocket.

— Shamik (@Writer_Foodie) July 18, 2023

These opinions reveal a rising dissatisfaction among taxpayers who are skeptical of the effectiveness and fairness of the tax code. The discussion extended to the realm of online gaming, as users drew attention to the recent imposition of a 28% tax on funds collected by gaming companies from customers. The absence of shared risk and reward emerged as a source of friction, adding to the unhappiness with the tax structure.

ADVERTISEMENT

ADVERTISEMENT