A customer recently took to social media platform X and tagged Zomato, questioning how many times the company plans to charge GST on food orders. Without any further ado, Zomato promptly responded, clarifying the concern.

Customer questions multiple GST charges on Zomato

On 31st August 2025, a man named Rashmiranjan Mishra took to social media platform X to raise his concern about Zomato’s billing system. Surprised by the breakup of charges, he tagged the food delivery giant and wrote,

ADVERTISEMENT

“Dear Zomato what is this? Tum kitne bar GST loge @zomato”.

His post reflected the confusion many customers face when encountering multiple tax components on food delivery apps like Zomato.

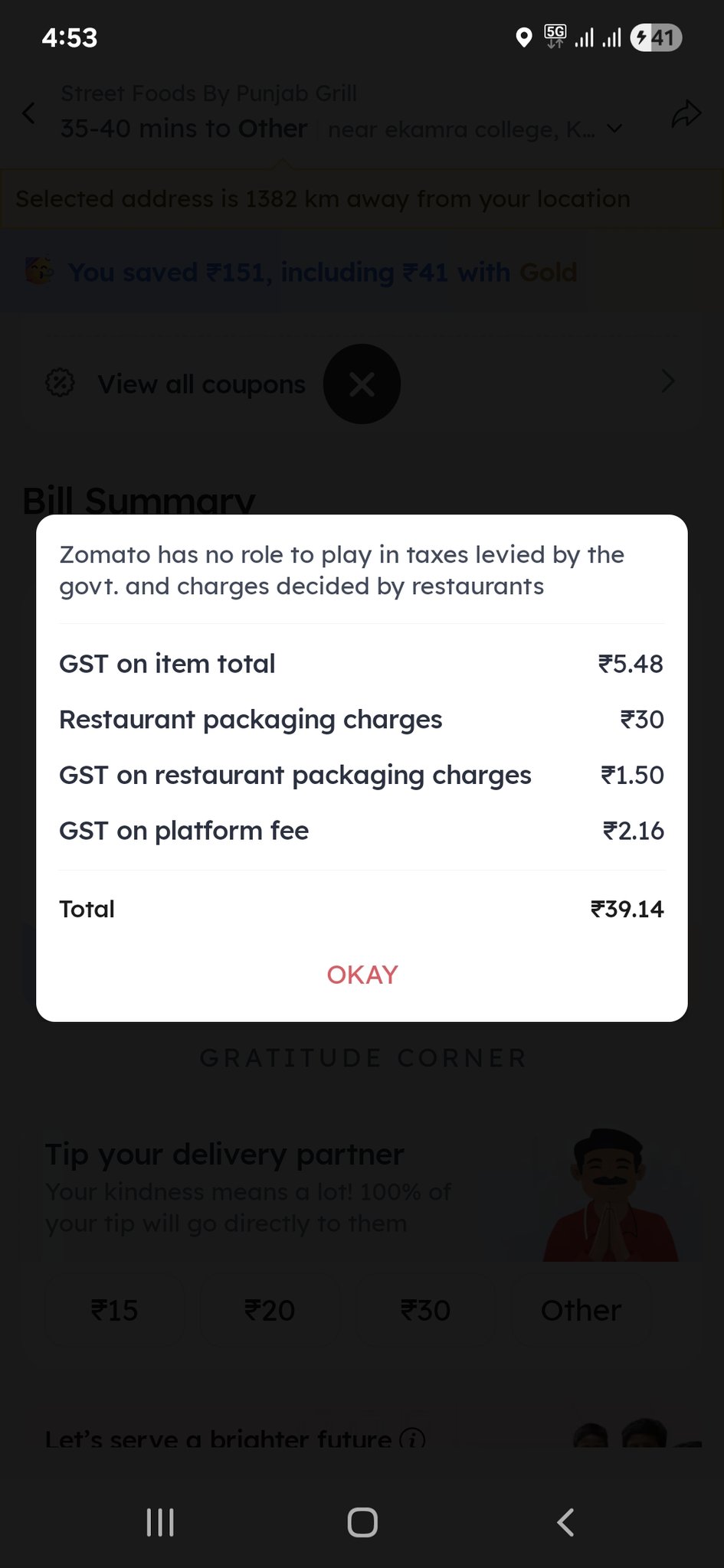

Mishra’s doubt stemmed from the detailed bill he received, where GST was levied on different heads. The screenshot he shared clearly displayed GST on item total, GST on restaurant packaging charges, and even GST on platform fee. This breakup gave the impression that GST was being charged multiple times on the same order, prompting him to publicly question the company’s billing practice.

ADVERTISEMENT

By posting the screenshot along with his caption, Mishra aimed to corroborate his claim and seek clarification directly from Zomato.

Have a look at the whole tweet

Dear Zomato What is this ? tum kitne bar GST loge @zomato pic.twitter.com/8ZwLCdutDN

— RASHMIRANJAN MISHRA (@rrmishra) August 31, 2025

Advertisment

Zomato took to the comment section and clarified the GST confusion

Without further ado, Zomato stepped into the comment section to address Rashmiranjan Mishra’s concern directly. The company acknowledged his query and clarified that there was no error in the billing process.

ADVERTISEMENT

Responding to his post, Zomato wrote,

“Hey Rashmiranjan, we’d like to clarify that GST calculation is done accurately as per the GST Law, and restaurant packaging charges are decided solely by our restaurant partners. Hope this clarifies your concern! If you have any further queries, please let us know, and we’ll be happy to assist you.”

Have a look at it,

Hey Rashmiranjan, we’d like to clarify that GST calculation is done accurately as per the GST Law, and restaurant packaging charges are decided solely by our restaurant partners. Hope this clarifies your concern! If you have any further queries, please let us know, and we’ll be…

— Zomato Care (@zomatocare) August 31, 2025

ADVERTISEMENT

By issuing this explanation, Zomato reassured the customer that GST is levied strictly in line with government regulations and that the packaging charges visible in the bill are decided by restaurants, not the platform itself.

What is GST? Is it really charged on delivery apps like Zomato?

GST refers to Goods and Services Tax which is a single and unified tax introduced in India on 1st July 2017. It was launched to replace multiple indirect taxes like VAT, service tax, and excise duty. It is charged on the supply of goods and services, meaning that whenever you buy something, whether it’s food, clothes, or a service, you pay GST as part of the price. It happens on delivery apps as well, like, Zomato.

The main idea behind GST is to simplify taxation by bringing it under one umbrella instead of having different taxes at different stages. It is collected by businesses from customers and then passed on to the government. This system ensures more transparency and reduces the chances of double taxation.

What are your thoughts on Zomato’s response? Do share via the comments below.