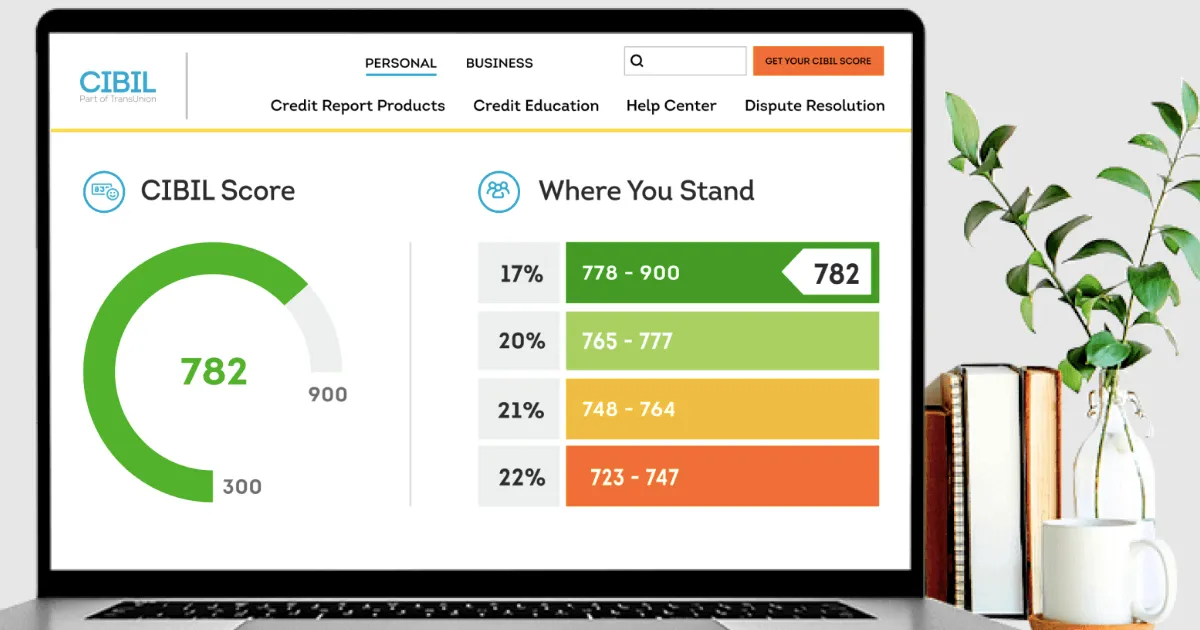

Your CIBIL score plays a crucial role in your financial journey. While you may be familiar with the basics, there are several lesser-known facts about your CIBIL score that can provide valuable insights.

In this post, we will explore the interesting things you may not know about your credit score.

ADVERTISEMENT

Multiple credit score checking platforms

In addition to CIBIL, which is the most well-known credit bureau in India, there are other credit bureaus such as OneScore, Experian, that generate credit scores. It’s important to note that each credit bureau may have its own scoring model, resulting in slight variations in the credit scores assigned to individuals. Therefore, it’s crucial to monitor and understand your credit scores and get a regular CIBIL score check from a reliable credit bureau to get a comprehensive report of your creditworthiness.

Influence of payment history

Your payment history plays a significant role in determining your CIBIL score. Making timely payments of your loan EMIs and credit card bills contributes positively to your score, reflecting your responsible financial behaviour. On the other hand, late payments or defaults can have a negative effect on your score, indicating a potential risk to lenders.

Credit utilisation ratio

Your credit utilisation ratio is the percentage of available credit that you are currently using. It’s an important factor in determining your CIBIL score. A high credit utilisation ratio indicates a higher risk of default and can impact your score. To maintain a healthy credit score, it’s advisable to keep your credit utilisation ratio below 30%.

ADVERTISEMENT

Credit mix matters

Having a diverse credit mix that includes a combination of different types of loans and credit cards can positively impact your score. Lenders prefer borrowers who have successfully managed various types of credit, as it demonstrates their ability to handle different financial responsibilities.

Short-term impact of credit inquiries

Whenever you apply for a new loan or credit card, it generates a “hard inquiry” on your credit report. Multiple hard inquiries within a short period can temporarily lower your CIBIL score. Lenders view frequent credit inquiries as a sign of increased credit risk. To minimise the impact on your score, it’s advisable to limit credit inquiries and apply for credit only when necessary. Be strategic in your credit applications and avoid unnecessary inquiries that may raise concerns about your

creditworthiness.

Importance of credit history length

The length of your credit history is also an important factor in determining your CIBIL score. A longer credit history provides more data points for lenders to assess your creditworthiness. It demonstrates your ability to handle credit responsibly over an extended period. It shows a longer credit history and contributes positively to your CIBIL score.

Regular credit report review

Regularly reviewing your credit report is essential to identify any errors or discrepancies that may be impacting your CIBIL score. You are entitled to receive one free credit report per year from each credit bureau, which you should take advantage of. By reviewing your credit report, you can ensure that the information is accurate and up-to-date. If you spot any inaccuracies, you can take corrective measures, such as disputing errors or providing necessary documentation, to rectify the situation and maintain an accurate credit profile.

ADVERTISEMENT

Role of loan guarantees

Being a loan guarantor can impact your credit score if the borrower defaults on the loan. As a guarantor, you become equally responsible for the loan repayment, and any defaults will reflect on your credit report. Therefore, it’s crucial to thoroughly evaluate the borrower’s creditworthiness and the risks involved before agreeing to be a loan guarantor.

Loan interest rates

Your CIBIL score directly influences the interest rates offered to you by lenders. A higher credit score increases your chances of securing loans at more favourable interest rates. Lenders consider individuals with good credit scores as having lower credit risks and are more willing to offer them competitive interest rates. Maintaining a good credit score not only improves your eligibility for loans but can also help you save money by accessing lower interest rates, reducing the overall cost of borrowing.

Impact of loan settlements and write-offs

Loan settlements and write-offs, though they may provide temporary relief, can have a long-lasting negative impact on your CIBIL score. Lenders view settlements and write-offs as signs of financial distress and an inability to repay debts as agreed. Therefore, it is advisable to explore alternative options, such as loan restructuring or negotiating with lenders, before considering settlements or write-offs.

ADVERTISEMENT

Conclusion

Understanding the lesser-known facts about your CIBIL score empowers you to make wise financial decisions. These insights can help you take proactive steps to improve and maintain a healthy credit profile. Regularly monitoring your credit score and practising responsible financial habits are key to achieving your financial goals.

ADVERTISEMENT