Like several other areas of trading bolstered by the quickness and immediacy of all things online, Cryptocurrency trading has become commonplace over the last few years, with more and more people looking to invest in digital assets such as Bitcoin, Ethereum and Dogecoin. However, as many unadulterated investors have had the opportunity to find out for themselves over the years, the crypto space is complex and the market highly volatile, two circumstances justifying the call for caution that seasoned traders generally direct at those entering this world for the first time. In this article, we will look at the essential factors that traders of all levels should bear in mind when engaging in cryptocurrency trading.

Understand the technology

Cryptocurrencies are built on a complex technology known as blockchain. A blockchain is, defined Wikipedia’s “a distributed ledger with growing lists of records (blocks) that are securely linked together via cryptographic hashes”. Right from its definition it is fairly easy to see how understanding the technological infrastructure underlying digital assets may represent a problem in its own right. Having said that, a deep dive into the inner workings of this database and the blockers stored therein will provide the uninitiated with the tools needed to understand the strengths and limitations of the various cryptocurrencies so as to make an informed decision on which one to start investing.

ADVERTISEMENT

Keep up-to-date with the latest news

The cryptocurrency market is fast-moving and highly dynamic, with new developments and news emerging on an almost daily basis. Staying informed about the latest news and developments can help traders gain a competitive advantage on other investors, this resulting in better decisions and, potentially, higher profits.

For example, if a new regulation is introduced that impacts the cryptocurrency market, traders need to be aware of it in order to respond to this paradigm shift by making an informed decision about their digital assets.

Diversify your portfolio

One of the key principles of investment is diversification, and this is especially true in the crypto market. Diversifying your portfolio helps to reduce risk and increase returns. Traders should consider investing in a range of currencies, including those with different use cases, technologies, and market capitalizations. As the old adage goes, it is always a good idea not to put all of your eggs in the same basket!

Be aware of market volatility

The volatility of the crypto market can be seen as a blessing or a curse depending on the situations, we can find ourselves in: one the one hand, the rapid fluctuation of the prices can lead even the least experienced investors to unexpected gains; the same unpredictability, however can pose the risk of significant losses for newcomers and experts alike. All traders are equal before lady crypto. And all traders need to be prepared to adjust their gameplan to win the favor of this fickle modern-day moira.

ADVERTISEMENT

Choose a reputable exchange

Online trading is done on exchanges and platforms like Equiti, and choosing a reputable exchange is essential to ensure the safety and security of your funds. Consider factors such as security measures, user-friendliness, and the range of currencies offered when choosing an exchange. It’s also important to choose an exchange that operates within your jurisdiction and is regulated by the appropriate authorities.

Understand risk management

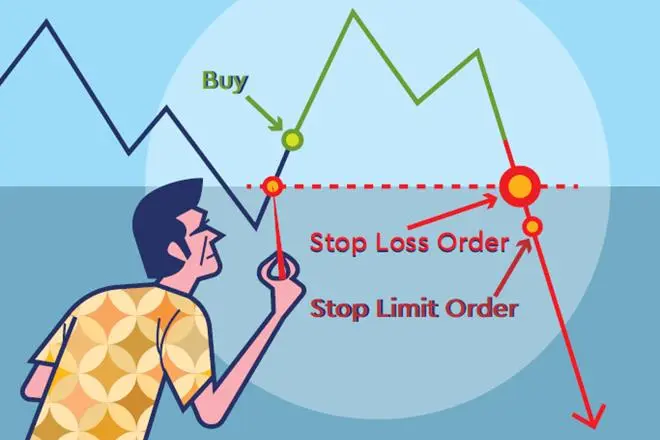

In a discipline where minimizing the potential for losses represents half the battle, the ability to understand risk management and be able to apply solid risk management strategies is the blitzkrieg every trader needs. Effective risk management strategies involve adjusting our portfolio regularly, setting stop-loss orders, and monitoring the market on an ongoing basis to identify potential risks.

Use stop-loss orders

Speaking of stop-loss orders, these are orders placed with brokers to buy or sell a specific stock when the stock reaches a certain price. As such they represent a very useful tool for managing risk in the market. When the instruction provided by the stop-loss order is applied to a sale transaction, it can be a godsend to ditch a stock that is rapidly declining in value, thus preventing further losses and granting the investor the opportunity to come back with a more successful investment.

Be patient

Trading requires patience and discipline. As mentioned previously what differentiates this particular market from other, more traditional ones, are the high dynamicity and the sudden changes which can cause a digital asset to boom or crash overnight. Hence it is best to avoid rushing into trades without a solid preliminary understanding of the market and the risks involved in trading a certain crypto over another. Traders need to be patient, do their research, and observe the ebb and flow of the latest market trends and only strike when the moment is right.

Have a long-term investment strategy

Investing in cryptocurrencies is not a get-rich-quick scheme, and traders should have a long-term investment strategy. This may involve investing in a range of cryptocurrencies and holding onto them for the long term, or using a combination of short-term and long-term strategies. The key is to have a clear and well-defined investment strategy, and to stick to it.

Seek professional advice

Finally, even in a space saturated with stories of self-made investors, it is always a good idea to seek professional advice. This can help traders make informed decisions and navigate the complex and volatile market. Whether it’s through a financial advisor or a cryptocurrency trading expert, seeking professional advice can provide traders with valuable insights and advice to help them achieve their investment goals.

ADVERTISEMENT

Conclusion

Cryptocurrency trading can be a lucrative investment opportunity, but it requires a high degree of caution and preparation. By keeping in mind all of the factors outlined in this article, traders can increase their chances of success in the crypto market.

ADVERTISEMENT